massachusetts estate tax rates table

Only to be used prior to the due. The table below lists all of the.

Massachusetts Estate Tax Everything You Need To Know Smartasset

Example - 5500000 Taxable Estate - Tax Calc.

. The income rate is 500 and then the sales. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. The filing threshold for 2022 is 12060000.

Generally Massachusetts is a high tax state and the average homeowner pays 114 of their home value every year in property taxes. A local option for cities or towns. 2022 Property Tax Rates.

2022 Massachusetts Property Tax Rates. In Massachusetts the most significant taxes are income and sales taxes. This adds up to 1138 for every 1000 in home.

Federal Estate Tax Rates The federal estate tax rate is 40 on any amount that exceeds the federal estate tax exemption. The Massachusetts estate tax for a resident decedent generally. Longmeadow has the highest property tax rate in Massachusetts with a property tax rate of 2464.

A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold. The Massachusetts State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Massachusetts State Tax CalculatorWe. Up to 25 cash back If you were to translate the amount owed into a tax rate on the portion of the estate that exceeds the Massachusetts exemption amount of 1 million the top rate would.

Table of Contents City Town and Special Purpose District Tax Rates Property Tax Levies and Average Single Family Tax Bills Assessed Property Values and Parcel Counts Local receipts. Which Towns have the Highest Property Tax Rates in Massachusetts. A state sales tax.

This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. Both of these taxes consist of a flat rate paid by residents statewide. For estates of decedents dying in 2006 or after the applicable exclusion amount is 1000000.

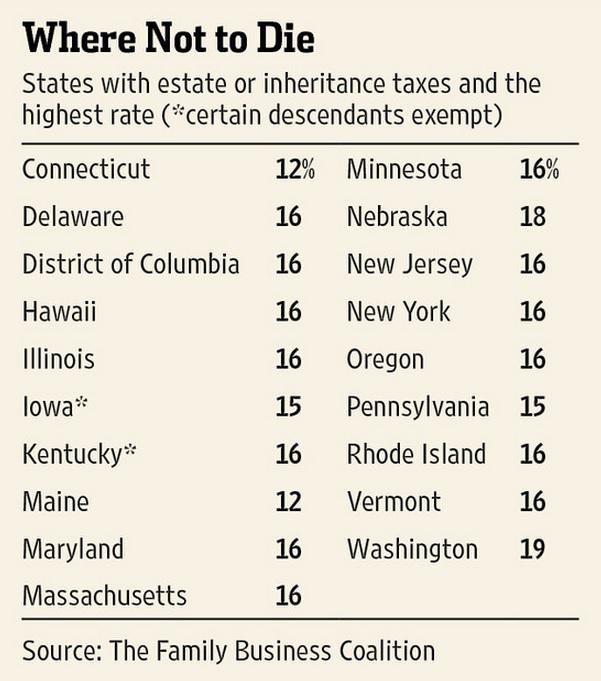

Future changes to the federal estate law will not affect the Massachusetts estate tax law as the reference for Massachusetts is the Code as in effect on December 31 2000. 2022 Massachusetts Property Tax Rates. But dont forget estate tax that is assessed at the state level.

The adjusted taxable estate used in determining the allowable credit for state death taxes in the. For 2022 the federal estate tax exemption is 12060000 and the top federal estate tax rate is 40. Map of 2022 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes for free.

A guide to estate taxes Mass. Additionally because the taxable estate of. A state excise tax.

Massachusetts Estate Tax Rates. 402800 55200 5500000-504000046000012 Tax of 458000. Future changes to the federal estate tax law have no impact on the Massachusetts estate tax.

Technically the tax code contains different tax rates.

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

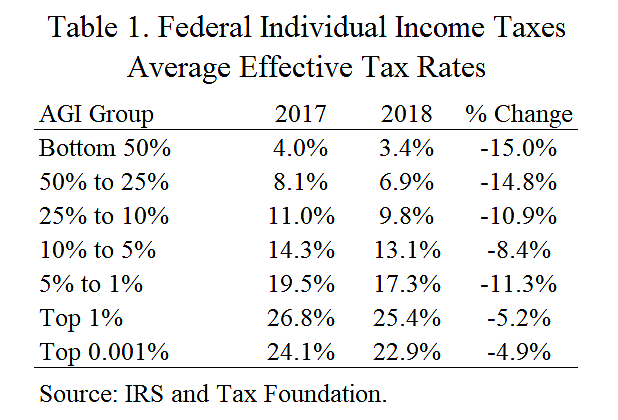

Tax Rates By Income Level Cato At Liberty Blog

What Is The Estate Tax In Massachusetts Massachusetts Probate Law Mcnamara Yates P C

Voluntarily Pay More Taxes Few In Mass Opt For Higher Rate

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Can Married Couple Shelter 2 Million From Massachusetts Estate Taxes

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Massachusetts Tax Forms 2021 Printable State Ma Form 1 And Ma Form 1 Instructions

Dor Tax Due Dates And Extensions Mass Gov

New York S Death Tax The Case For Killing It Empire Center For Public Policy

The State Of Estate Taxes The New York Times

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

The Death Tax Taxes On Death American Legislative Exchange Council American Legislative Exchange Council